HPSO Student Insurance is a sort of insurance that is highly recommended for all students because it will help cover their medical expenses.

HPSO (Healthcare Providers Service Organization) is an insurance company that specializes in providing insurance to healthcare professionals, especially students studying in the field.

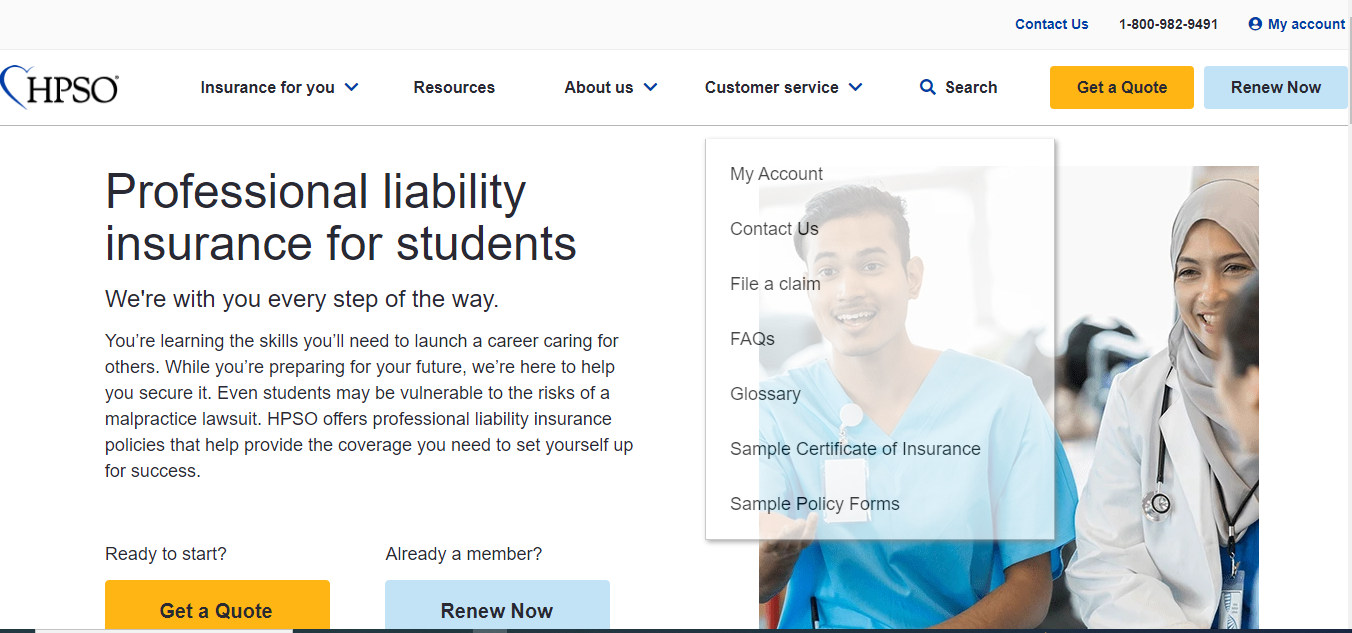

HPSO Student Insurance is a type of insurance that is designed to fulfill the needs of students pursuing degrees or certificates in healthcare professions.

These plans may include professional liability, malpractice insurance, and other types of insurance pertinent to the healthcare industry.

Also Read Travel Insurance ICICI Lombard: Everything You Should Know

HPSO Student Insurance: Types Of Coverage

HPSO Student Insurance provides a variety of coverage options to satisfy the unique needs of students studying in various healthcare disciplines.

The following are some of the most prevalent forms of coverage offered by HPSO Student Insurance:

HPSO Student Insurance’s principal coverage is professional liability insurance. It shields students from legal claims and lawsuits if they are accused of making blunders, errors, or omissions while studying or caring for others.

This coverage is critical for healthcare students because medical errors can have catastrophic implications.

Malpractice Insurance: In the healthcare industry, professional liability insurance is commonly referred to as malpractice insurance.

It covers professional negligence or malpractice claims, which might include medical errors, misdiagnoses, or other errors committed by healthcare students during their education and training.

Occurrence Form Coverage: This type of coverage protects you for incidents that happen while your policy is in existence, regardless of when you file a claim.

It means that if a student has an incident during their coverage term and then files a claim, the policy will still cover that incident.

Related AAA Auto Club Insurance: Everything You Should Know

Claims-Made Coverage: Claims-made coverage protects against claims made while the insurance is in effect.

The incident or alleged malpractice must, however, occur while the policy is in effect, and the claim must be filed during the same policy period. In the insurance industry, this form of coverage is more widespread.

Tail coverage, sometimes known as an extended reporting endorsement, enables students to file claims for incidents that occurred within their coverage term even after they have graduated or completed their school.

It is critical for healthcare students who may face claims after graduating from their educational institution.

Prior Acts Coverage: This option protects against incidents that occurred prior to the start date of the insurance but were previously unknown or unreported. It is critical for students who desire coverage for incidents that occurred prior to the purchase of their insurance.

Consent to Settle: Some policies require the insurance company to acquire the student’s consent before settling a claim. This clause ensures that students have a say in how accusations against them are resolved.

HPSO Student Insurance frequently includes coverage for legal defense costs in addition to covering the cost of settlements or verdicts.

This means that the insurance provider will cover the costs of lawyers and other legal fees incurred by the student in the event of a claim or litigation.

Who Is Eligible For HPSO Student Insurance?

You must be enrolled in an accredited healthcare program to be eligible for HPSO Student Insurance.

Nursing schools, medical schools, dental schools, physical therapy programs, and other programs are examples of such programs.

The insurance is particularly intended for students who are actively involved in healthcare-related educational activities.

If you are an international student studying healthcare in the United States, you may be qualified as well, but you need to confirm this with HPSO or their agents.

It is critical to understand that the exact requirements will differ depending on the specific insurance policy and the insurance provider’s guidelines.

If you’re unsure if you qualify, contact HPSO directly to learn more about your eligibility and the insurance alternatives that are best for you as a healthcare student.

Also Read Allstate Insurance in Maryland: Everything You Should Know

Coverage Tailored to Students

HPSO Student Insurance was created primarily to meet the needs of students. It recognizes that students frequently have low financial means and tries to provide affordable insurance coverage for them.

This enables students to concentrate on their studies rather than worrying about future legal claims or responsibilities.

How long does it last?

Obtaining HPSO student insurance can take some time, depending on a few factors. It could be short or take several days or weeks.

The evaluation procedure for HPSO student insurance might take anywhere from a few days to several weeks.

The time it takes is determined by factors such as the volume of applications received, the completeness of your submission, and HPSO’s unique policies. Some candidates are approved quickly online, while others may face delays if extra documents or information are required.

To ensure a timely response, submit a full application and promptly comply with any document requests.

Consider contacting HPSO to inquire about the progress of your application if you have specific issues or deadlines.

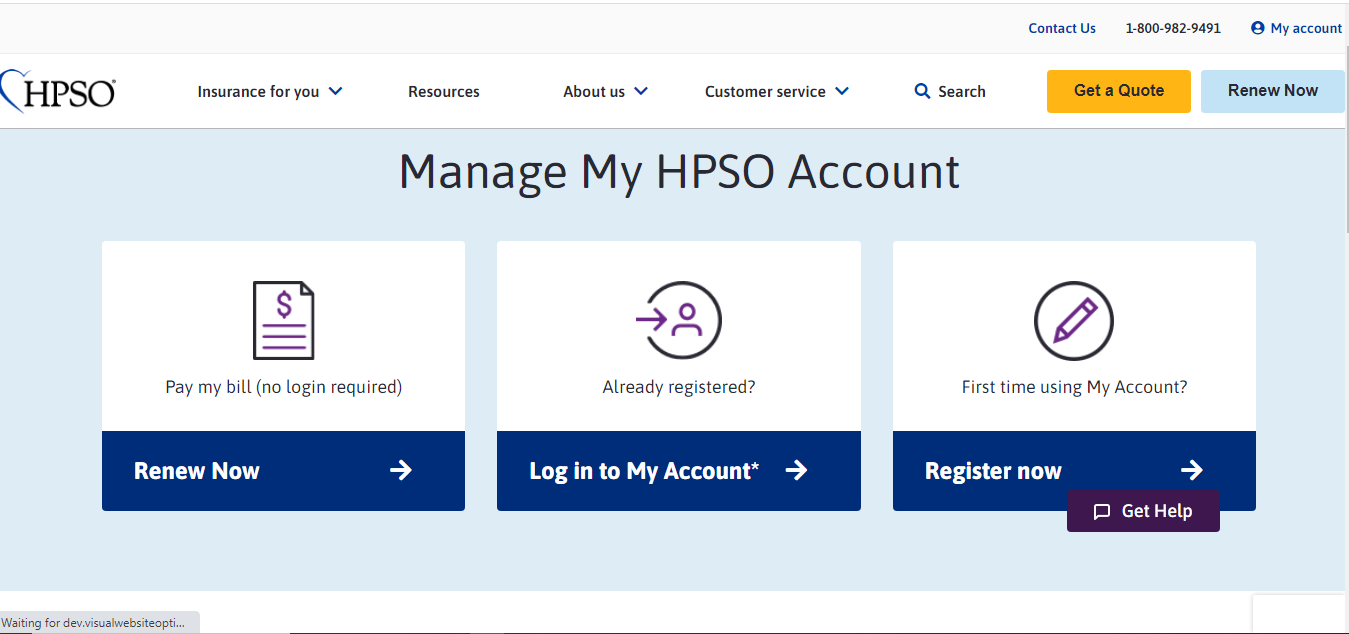

How To Get HPSO Student Insurance

Obtaining HPSO insurance is a simple process, which we have detailed below: Read the procedures below:

Investigate and compare: Begin by studying various insurance companies and policies. Compare coverage options, costs, and policy features to choose which one best meets your needs.

Apply Online: You may apply for HPSO insurance online with most insurance companies. Personal information, facts about your educational program, and information about any prior claims or legal actions will be required.

Read More: Auto Insurance With Suspended License: Everything You Should Know

Select your coverage: Choose the level of coverage and any further extensions that meet your individual needs. The cost of your policy will be determined by the coverage you select.

Payment: Pay your policy’s premium. Some insurance companies allow student discounts, so inquire.

Proof of Insurance: After obtaining HPSO insurance, you will receive proof of coverage, which you can give to your educational institution, clinical sites, and certifying organizations as needed.

Renewal: Because HPSO insurance is often an annual policy, be prepared to renew your coverage each year to assure continued protection throughout your academic journey.

Conclusion

HPSO insurance is critical for students studying medicine. It protects students against problems such as blunders and other legal issues that may arise during their schooling.

Students can concentrate on their studies and training, knowing they are safe with this insurance.

When choosing this insurance, consider how much it covers, extra options, the insurance company’s reputation, cost, and how to file claims to ensure you have adequate coverage both during and after school.